Predicting an uncertain future

- Papama Nyati

- May 15, 2020

- 4 min read

The ingenuity, resourcefulness and resilience of startup businesses in Africa are being put to the test like never before. COVID-19 has shaken up societies and economies of the world at an unprecedented scale. With a recession on the horizon, the pandemic has put a high level of uncertainty and poses many challenges to Africa’s startup ecosystem.

Warren Buffett famously said, “Only when the tide goes out do you discover who’s been swimming naked.” This epigram can be applied to shed light to some of the unaddressed vulnerabilities of the African tech ecosystems, that have now been exposed more than before.

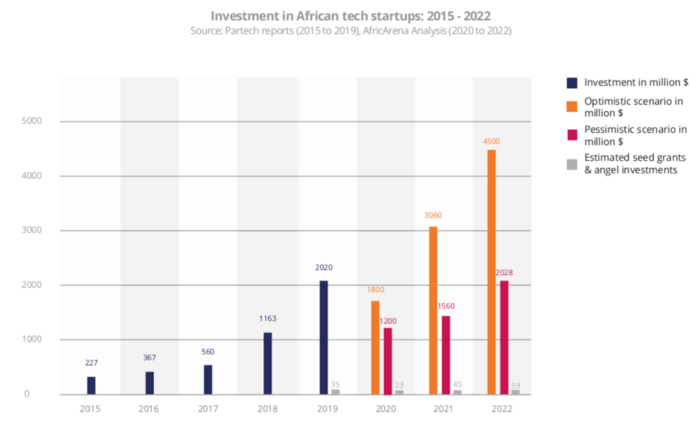

The story was incredible to witness as it unfolded: tech startups in Africa raising record-breaking rounds, year-on-year. The earliest consolidated recording of total funding and deals in African tech dates back as recently as 2015, where the total deal value was estimated at over $200 million. In 2019, total funding was estimated at north of US$ 2 billion across +/- 250 VC deals (Partech Africa, 2019). The African startup ecosystem has seen a considerable upward trend in a short period of time.

However, one of the major cracks in the venture funding space in Africa has been the disproportionate allocation of capital — where capital is highly concentrated on growth-stage companies, while seed/early-stage companies are under-subscribed at less than 10% of the total funding. Startups that raised Series B and above in 2019, secured 70% of the $2 billion across 44 deals, while Series A secured 23% across 79 deals. At the bottom of the investment funnel are early-stage startups, that secured 7% in 127 deals. These numbers reveal that investor confidence is rested on companies with previous rounds of funding — or rather, investor confidence begets investor confidence.

The challenge with this cautious approach is that it starves the early-stage development that is much needed. A survey conducted by AfricArena among its community of entrepreneurs found that the biggest hurdle for many of them in the early stages is moving forward with their MVP — in terms of customer acquisition/market access and affording the technical expertise needed to iterate their product offering. A lack of funding during these survival-mode times can be a run into the ground.

If anything, the COVID-19 outbreak has further exposed the fragility of Africa’s young startup ecosystem, where the large majority of entrepreneurs are not backed by investors, local government or any organised support structures. With this reality in place, we can anticipate the $2 billion milestone of 2019 to drop in 2020. Based on the deal momentum of $343m in the first quarter of 2020 (Maxime Bayen, Greentec Capital) which factored a 27% YoY growth, we can expect deal activity to fall sharply in Q2 and Q3 2020, primarily fuelled by VCs doing refinancing deals on their portfolio of companies rather than venturing into new deals. The worst-case scenario (of $1.2-billion) will see no significant pick up in deals this year, while the best-case scenario (of $1.8 billion) factors a strong uptake in the fourth quarter.

The deals we have seen in Q1 so far have been primarily refinancing deals — with 4 companies (54gene, Flutterwave, JUMO and Helium Health) receiving half of the funding. This is a trend we can expect for 2020, which means most seed and early-stage companies will be left to fend for themselves. Despite this, even top-funded startups are feeling the pressure. South Africa’s leading point-of-sale solutions provider, Yoco, has had to lay-off some of its labour force and take pay cuts, so to ensure its survival and continue to provide its fintech solutions to the 75,000+ merchants in its network.

A survey by i4Policy Foundation reveals that 44% of startups in Africa are at risk of shutting down as they have just enough runway for 3 months. Furthermore, around 40% of community tech hubs are also at risk of shutting down in the next 3 months. Early-stage companies will be largely wiped out in the coming 3 to 9 months, destroying much of the future pipeline of investors. We do not expect angel investment or seed funds to be able to perform well in the current context and therefore the continuous lack of early-stage investors on the continent might prove particularly problematic at this juncture.

2021 and 2022 remain highly uncertain. The worst-case scenario for both years ($1.6 billion and $2 billion respectively) is based on a prolonged and fragmented impact of the pandemic on African economies, and the response measures placed by governments in the next couple of months. Governments in Africa will have to step up more than before to save small businesses — the backbone of economies. This can be done through a fiscal stimulus, working with public sector banking institutions to ease access to loans and emergency credits.

With startups across the continent being thrown in the deep end, their best lifeline lies in the durability of their business model and value chain, and how they pivot to safe shores. Just like the previous global recession, the ones that survive this storm will be the success stories of tomorrow. While we can count on the resilience and ingenuity of African entrepreneurs, much will need to be done to save the enormous potential of the sector.

Comments